Get the free ssa 7005 form

Show details

Social Security Earnings & Benefits Information — Detail (SSA-7050-F4) (4 pages) ... You can also download the forms at www.macropro.com ...... *This form is available at http://www.archives.gov/research/order/standard-form-180.pdf

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ssa 7005 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ssa 7005 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ssa 7005 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit social security form ssa 7005. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

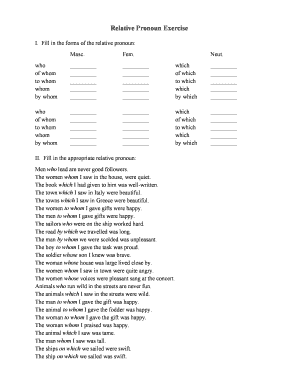

How to fill out ssa 7005 form

Point by point how to fill out ssa 7005:

01

Begin by downloading the SSA 7005 form from the official Social Security Administration website.

02

Fill out the top section of the form, including your name, Social Security number, and contact information.

03

Indicate whether you are applying for benefits as an individual or as a representative payee.

04

Provide information about your earnings, including your employer's name, address, and the dates you worked.

05

Fill in details about any other government benefits you are receiving or have applied for.

06

If you are applying for disability benefits, provide information about your medical condition, treatments you have received, and healthcare providers you have visited.

07

Review the completed form for accuracy and sign it.

08

Make a copy of the filled-out form for your records before mailing it to the appropriate Social Security Administration office.

Who needs ssa 7005:

01

Individuals who are applying for Social Security benefits, including retirement, disability, or survivor benefits, may need to fill out form SSA 7005.

02

Representative payees who are applying on behalf of someone else, such as a minor or an individual who cannot manage their own affairs, may also be required to complete this form.

03

The SSA 7005 is necessary to gather important information about an individual's employment history, financial situation, and medical condition in order to determine eligibility for Social Security benefits.

Fill form : Try Risk Free

People Also Ask about ssa 7005

How long does it take Social Security to update your earnings?

What is the maximum Social Security benefit for 2023?

What is a SSA 7050 form?

What is a SSA 7005?

Where do I get my Social Security tax statement?

How do I get an itemized statement of earnings?

Does Social Security still send out yearly statements?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ssa 7005?

SSA 7005 is a form used by the Social Security Administration (SSA) in the United States. The form is officially known as the "Request for Social Security Earnings Information" and is used to request information about an individual's earnings history or to obtain proof of Social Security benefits for various purposes such as verifying wages for retirement planning, disability determinations, or other government programs. The form requires the individual's personal information, Social Security number, and the reason for the request.

Who is required to file ssa 7005?

SSA-7005 is a form used by the Social Security Administration (SSA) to request information from school officials in order to determine a student's eligibility for Social Security benefits. Therefore, the form is typically filed by school officials or administrators, such as college financial aid offices or high school counselors, on behalf of a student.

How to fill out ssa 7005?

To fill out the SSA-7005 form, also known as the "Request for Social Security Earnings Information," follow these steps:

1. Download the SSA-7005 form from the official Social Security Administration (SSA) website, or obtain a physical copy from your local SSA office.

2. Begin by entering your personal information in Section 1. This includes your full name, social security number, date of birth, and current mailing address.

3. In Section 2, indicate the specific information you are requesting by checking the appropriate box(es). This could include earnings information, self-employment information, or both. Provide any additional details required for your request in the provided space.

4. Section 3 is for optional use. You may skip this if it doesn't apply to your situation.

5. In Section 4, indicate how you would like to receive the requested information. You can choose to receive it online via the mySocialSecurity portal, by mail, or both.

6. If you want someone else to receive the requested information on your behalf, complete Section 5. This requires providing the individual's name, address, and relationship to you. Both you and the designated individual must sign and date this section.

7. In Section 6, indicate if you are currently incarcerated. If yes, include the facility name, ID number, and expected release date.

8. Read the Important Information provided in Section 7 and ensure you understand the terms and conditions before proceeding.

9. After completing the form, sign and date it in Section 8.

10. Review the information you provided on the form to confirm its accuracy and completeness.

11. Make a copy of the filled-out form for your records, and retain any supporting documents if required.

12. Submit the completed form to the SSA via mail or in-person at your local SSA office.

What is the purpose of ssa 7005?

SSA Form 7005 is used by the Social Security Administration (SSA) to gather information from individuals who are requesting a hearing in front of an Administrative Law Judge (ALJ) to appeal a decision regarding their Social Security benefits.

The purpose of SSA Form 7005 is to provide the necessary information to the SSA regarding the individual's identification, contact details, Social Security number, and the specific decision they are appealing. This form helps the SSA streamline the hearing process and ensure that the individual's appeal is appropriately handled.

By completing and submitting SSA Form 7005, individuals can request a hearing to present their case and provide additional evidence or arguments to support their claim for Social Security benefits.

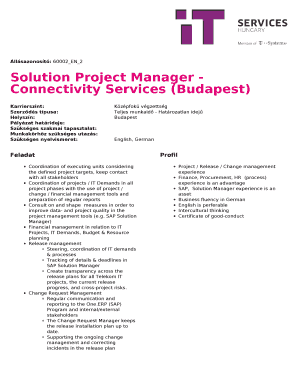

What information must be reported on ssa 7005?

SSA Form 7005 is used to report wages or self-employment income earned by individuals who have received Supplemental Security Income (SSI) benefits. The following information must be reported on this form:

1. Personal Information: The individual's name, Social Security Number, and contact information.

2. Employer Information: If the individual is reporting wages, they must provide the name, address, and Employer Identification Number (EIN) of the employer(s) they worked for.

3. Self-Employment Information: If the individual is reporting self-employment income, they must provide details of their business, such as the nature of the business, business name, address, EIN (if applicable), and a description of the services or products offered.

4. Income Details: The individual must report the amount of wages or self-employment income they earned during the reporting period. This includes gross earnings before any deductions.

5. Expenses: If the individual is reporting self-employment income, they may also report allowable business expenses incurred during the reporting period. These expenses can be deducted from the gross income to arrive at net self-employment income.

6. Certification: The individual must sign and date the form, certifying that the information provided is true and accurate.

It is important to note that failure to report wages or self-employment income accurately and promptly may result in overpayment of SSI benefits, which could lead to penalties or loss of benefits.

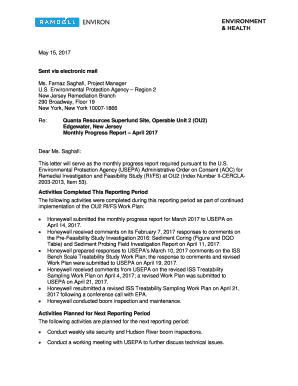

What is the penalty for the late filing of ssa 7005?

The Social Security Administration (SSA) Form 7005 is used to report wage and tax statements. Failure to file the form by the due date can result in penalties imposed by the IRS.

As of 2021, the penalties for late filing of Form SSA-7005 are as follows:

1. If you are 1 to 30 days late: $50 penalty per form.

2. If you are more than 30 days late but file by August 1: $110 penalty per form.

3. If you file after August 1 or do not file a required form: $280 penalty per form.

These penalties can increase further if it is determined that the late filing was due to intentional disregard of the filing requirements. Additionally, penalties may vary depending on the number of employees or the size of the business.

It is important to note that these penalties may change over time, so it is always recommended to refer to the official IRS guidelines or consult a tax professional for the most accurate and up-to-date information.

How do I make edits in ssa 7005 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your social security form ssa 7005, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit form 7005 straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing form ssa 7050 f4 fillable right away.

Can I edit online 7050 f4 ordering online on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign request for social security earnings information form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your ssa 7005 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 7005 is not the form you're looking for?Search for another form here.

Keywords relevant to ssa 7005 application form

Related to ssa 7050 f4 2018

If you believe that this page should be taken down, please follow our DMCA take down process

here

.